pay2phone by Bank Islam

Please note that this feature is no longer available.

pay2phone is a solution that enables merchants to accept contactless credit or debit card transactions via merchant’s own android mobile phone. Exhibitor/merchant just need to unlock their device and tap their customer card at the back of the phone. Merchant’s phone must be equipped with NFC, Android 8.0 and above, able to access to Google Play application store and Google Mobile Services. The solutions also comes with a full set of merchant management functions such as e-receipt, merchant dashboard, risk management control etc.

A. How to apply ?

Register here

B. What are the documents required ?

1. SSM registration

2. Copy IC of director

3. Bank statements

4. Site visit photos :

- Premise photos (with signboard)

- Premise photos with neighbouring shop

- Interior photos (product)

- Interior photos (payment counter)

C. How to use pay2phone?

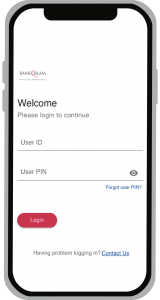

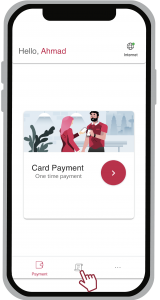

1. Login to your account with your User ID given and password.

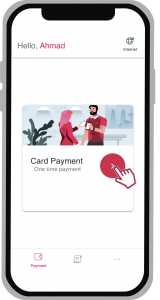

2. Tap next on the arrow button.

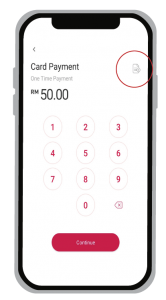

3. Put your sales amount for your customer to pay.

Optional : Insert transaction description by selecting the icon, on the right top.

4. Tap your customer credit/debit card at the back of the Android smartphone, to receive your payment instantly. Once the card is tapped on the smartphone, the payment will be processed.

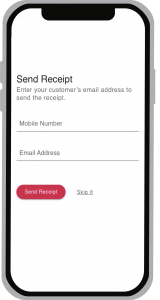

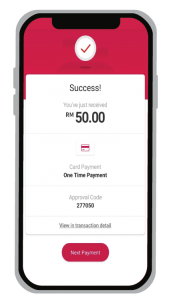

5. Once payment approved, e-receipt page will be prompted. Fill in all the details and tap ‘Send Receipt’. And you’re done !

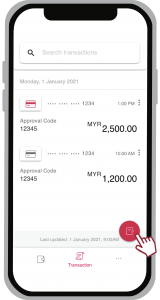

D. View sales history, credit settlement, void payment & resend e-receipt

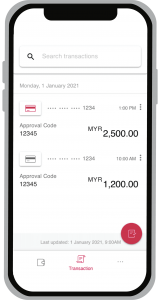

1. At the payment page, navigate to ‘Transaction’.

2. Sales History

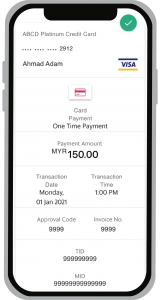

- Select the designated transaction to view complete details of the payment

3. Transactions processed will be displayed with the following information:

- Date & Time of payment

- Approval code

- Total unsettled amount

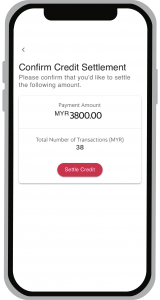

E. Credit settlement

1. Go to credit settlement option by selecting the ‘notes’ icon.

2. Enter user PIN

3. Confirm and settle by selecting ‘Settle Credit’.

Please take note that :

All transactions should be checked and reviewed before settlement. After settlement, all transaction information will not be displayed.

F. What are the requirement to use pay2phone ?

1. Using Android 8 and above.

2. Able to access Google Play application store.

3. Applicable with NFC-enabled Android smartphones.

4. Have an internet connection.

G. List of mobile phone with NFC

1. Asus – Android

- MeMO Pad 8 (ME581CL)

- Padfone 2

- Padfone Infinity

- Vivo Tab

- Vivo Tab RT

- VivoTab Smart

- ZenFone 2

- Zenfone 4

- Zenfone 5

- Zenfone 6

2. Google – Android

- Nexus 10

- Nexus 5

- Nexus 5X

- Nexus 6

- Nexus 6P

- Nexus 7 (2013)

- Nexus 9

- Pixel

- Pixel 2 and Google Pixel 2 XL

- Pixel XL

- Project Tango tablet

3. Samsung – Android

- Galaxy Z Flip

- Galaxy Z Fold3

- Galaxy Note 5

- Galaxy Note 8

- Galaxy Note 9

- Galaxy S6 Edge

- Galaxy S7

- Galaxy S7 Edge

- Galaxy S8

- Galaxy S8 Plus

4. Huawei – Android

- Honor 8

- Honor 9

- Mate 10 & Mate 10 Pro

- Mate 8

- Mate 9

- P10

- P10 Plus

- P8

H. Frequently Ask Question

1. What is pay2phone ?

- pay2phone is an app by Bank Islam Malaysia Bhd that enables merchants to accept contactless credit or debit card transactions via merchant’s own android mobile phone. Exhibitor/merchant just need to open pay2phone app and tap their customer card at the back of the phone.

2. What are the requirements to use pay2phone?

- Merchant’s phone must be equipped with NFC, Android 8.0 and above, able to access to Google Play application store, Google Mobile Services and have internet connection.

3. What is NFC?

- NFC stands for Near Field Communication. Essentially, it’s a way for your phone to interact with something in close proximity. It is quite handy for transferring data between two devices. Whether you want to send photos, videos, files, or make a payment, NFC can make it easy to do so.

4. How many merchants can apply for this facility?

- Limited to 300 merchant only. First come first serve basis.

5. How long to receive payments into bank account ?

- Settlement to merchants will takes 3 working days.

6. How long it takes to get approval from Bank Islam to use pay2phone apps ?

- Approval will takes 14 working days.

7. What is the default transaction limit?

- RM 500 per transaction

- RM 5,000 per day

- RM 100,000 per month

8. Transaction Limit Increase Request

- For any inquiries regarding the enhancement of your transaction limit, we kindly request that you contact our dedicated support team at [email protected]. Just a friendly heads-up, the approval of the transfer limit request will depend on Bank Islam’s decision.

9. Limitations on Device Usage

- At pay2phone, we have implemented certain restrictions on the usage of devices. These limitations, while they may appear to restrict access to pay2phone, are in place to ensure a seamless user experience and safeguard the integrity of our system. Please note that these limitations apply exclusively to one designated phone number.

10. What is minimum amount for settlement?

- The minimum settlement amount is RM100. Meaning, if the amount is less than RM100, senangPay will not transfer the money to you.

11. Why is my login attempt unsuccessful?

- The User ID and/or User PIN provided may be incorrect.

- There could be a connectivity error affecting the login process.

- The user account might have been suspended by the acquirer or has been inactive.

12. What should I do if I have forgotten my User PIN?

- If you encounter difficulty accessing your account due to a forgotten User PIN, we kindly request that you reach out to our dedicated support team at [email protected].

13. Why is my pay2phone application failing to detect the customer’s card?

- It is highly probable that the card being used is a non-contactless card. To ascertain whether the card is indeed contactless, kindly locate the contactless symbol displayed on the card.

14. Can pay2phone facilitate card payments that are not contactless?

- pay2phone only accepts contactless payments performed via contactless cards. Contact cards or chip payments are not supported.

15. How to get pay2phone apps ?

- Download here .