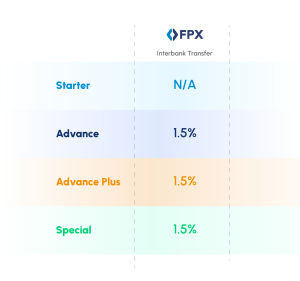

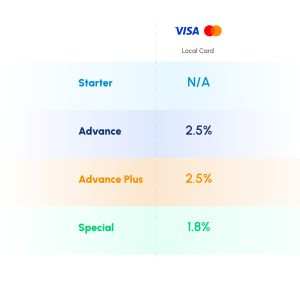

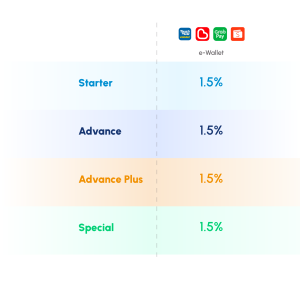

Transaction Fees for senangPay Package

A. 1.5%, FPX

The 1.5% charge, is the charge that senangPay charges the merchant on every Internet Banking (FPX) transaction for Advance & Special Package. Meaning, any transaction that the customers make through locally supported banks such as Maybank2u or CIMB Clicks, senangPay will charge 1.5% per transaction, regardless of how much the transaction amount is. For example, if the transaction is RM100, then senangPay will charge RM1.50 on this transaction. Thus, the merchant will receive RM98.50. Please take note that this is a simple calculation without GST.

B. 2.5% – Local Credit & Debit Card (Advance & Advance Plus Package)

The 2.5% charge is the charge that senangPay charges the merchant on every credit card. For example, if the transaction is RM100.00, then senangPay will charge 2.5% from this RM100.00, which is equivalent to RM2.50. Thus, merchants will receive RM97.50 on the scheduled settlement pay out. Please take note that this is a simple calculation without GST.

C. 1.8% – Local & Debit Credit Card (Special Package)

The 1.8% charge is the charge that senangPay charges the merchant on every local credit card.

D. 1.5%, e-Wallet

senangPay charges a 1.5% fee to the merchant on every e-Wallet provider; Touch ‘n Go, Boost, GrabPay & ShopeePay payment transaction.

Transaction Fees for senangPay X Stripe Package

A. What is 2.1%, 4.1% or 3.9%,5.9% rate?

The charge that senangPay charges the merchant on every credit or debit card transaction :

| Currency | Local Card | Foreign Card |

|---|---|---|

| MYR | 2.1% + 0.50 | 3.9% + 0.50 |

| USD | 4.1% + 0.30 | 5.9% + 0.30 |

| EUR | 4.1% + 0.30 | 5.9% + 0.30 |

| IDR | 4.1% + 3500 | 5.9% + 3500 |

| THB | 4.1% + 10.00 | 5.9% + 10.00 |

| JPY | 4.1% + 28.00 | 5.9% + 28.00 |

| AUD | 4.1% + 0.40 | 5.9% + 0.40 |

| GBP | 4.1% + 0.20 | 5.9% + 0.20 |

B. Additional Charges 2%

1. Please take note that additional 2% foreign exchange fees are charged for transaction presented in currency other than MYR.

2. Example of calculation :

Transaction with an amount of MYR 100 and using Malaysian cards:

Charges applicable – 2.1% + MYR 0.50

Total MDR – MYR 2.60

Total settlement to merchant: MYR 97.40Transaction with an amount of MYR 100 and using non Malaysian cards:

Charges applicable – 3.9% + MYR 0.50

Total MDR – MYR 4.40

Total settlement to merchant: MYR 95.60Transaction with an amount of USD 100 and using Malaysian cards:

Charges applicable – 4.1% + USD 0.30

Total MDR – USD 4.40

Total settlement to merchant: USD 95.60

The settlement amount will be converted to MYR amountTransaction with an amount of USD 100 and using non Malaysian cards:

Charges applicable – 5.9% + USD 0.30

Total MDR – USD 6.2

Total settlement to merchant: USD 93.80

The settlement amount will be converted to MYR amount

B. Who bears the 2.1%, 4.1% or 3.9%, 5.9% cost?

The cost is under the merchant’s responsibility. Which means, it is a business cost to the merchant.