Payment and Refunds

Reasons for FAILED Transaction

1. Reasons for failed transactions are usually received as a response from Visa / Mastercard / FPX / Bank.

2. It is beyond senangPay’s control, unless we notify merchants that senangPay is having a technical problem that affects the transaction process.

A. Most common reasons

1. Below are some of the most common reasons for failed transactions:

| Credit Card | FPX |

|---|---|

| Bank Declined Transaction | Transaction Not Found |

| 3D Secure Authentication failed | Buyer Cancel Transaction |

| Insufficient funds | Buyer Choose Cancel At Login Page |

2. Below are further details for the reasons:

2.1 Bank Declined Transaction

- The bank that issued your card may decline the anticipated transaction due to safety reason – to avoid fraud. This situation usually happens when your buyer is from another country. When the buyer proceeds with the transaction, the card issuer (the bank) sees it as a dangerous activity as the transaction is cross-border. This situation can also happens to a customer who suddenly has a big appetite for purchase – buying items beyond their usual transaction amount, such as items costing thousands of Ringgit.

- A quick solution for your customer is to ask them to call their bank to permit the transaction to happen. However, do note that there are several other reasons that can contribute to this failure. The cardholder might have entered the wrong details or the purchase limit has been reached.

2.2 3D Secure Authentication failed

- 3D Secure Authentication is a fraud-prevention scheme controlled by VISA and MasterCard. It works by sending the buyer a code or password via text message which has to be keyed-in on the authentication page. Transaction failure may occur here, in the event that the customer failed to key in the correct code or stays too long on the authentication page.

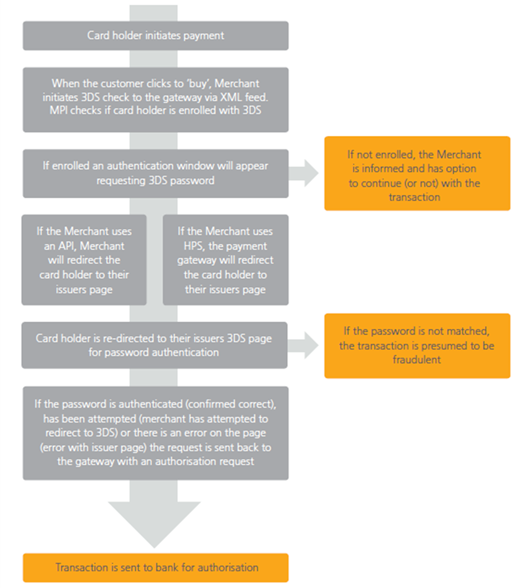

- Below is a diagram on how this 3DS works, taken from www.mastercard.com.

2.3 Insufficient funds

- “Funds” here means the amount of money in the bank account.

- Your customer might have an amount lower than the price value of the desired item.

- For example, the item is RM2,000, but your customer’s bank account has funds that is lower than that.

2.4 Transaction Not Found

- This situation can happen when buyers choose to click the browser’s back button or spends too much time on the authentication page.

- Simply put, the system somehow failed to store the code or password given earlier to the buyer, hence, the bank system detects the transaction as “lost.”

- To overcome this situation, the buyer needs to restart the purchasing process from the beginning. Make sure to not spend too much time on the authentication page.

2.5 Buyer Cancel Transaction

- If your buyer chooses to cancel the transaction…then, there is nothing that a merchant can do.

2.6 Buyer Choose Cancel At Login Page

- Same situation here as the above. You have to let your prospective customer go.

B. What should I do?

The merchants need to contact the bank involved in the transaction or ask the customers to contact their bank for more information about the failed transaction.